For 25 years, New England’s wholesale electricity markets have attracted billions of dollars in private investment in some of the most efficient, lowest-emitting power resources in the country—providing reliable electricity every second of every day, lowering wholesale prices, shifting costly investment risk away from consumers, and reducing carbon emissions. Because private firms make this investment and not public utilities, consumers are shielded from the investment risks they had been exposed to before the introduction of competitive markets.

Here’s the breakdown of the amount of electricity produced by generators in New England and imported from other regions to satisfy all residential, commercial, and industrial customer demand during 2023. This is called net energy for load (NEL).

Note: Data is preliminary, pending a resettlement period (last update: 01/19/2024.) For the most current information, download the Net Energy and Peak Load by Source spreadsheet.

| GIGAWATT-HOURS (GWH) | % of GENERATION | % of NEL | (a) As of January 2016, this chart approximates the amount of generation by individual fuels used by dual-fuel units, such as natural-gas-fired generators that can switch to run on oil and vice versa. Previously, the report attributed generation from such units only to the primary fuel type registered for the unit. The new reporting flows from changes related to the Energy Market Offer Flexibility Project implemented December 2014. See the notes in the Net Energy and Peak Load by Source Report for more details. (b) Hydro is not included in the renewables category primarily because the various sources that make up hydroelectric generation (i.e., conventional hydroelectric, run-of-river, pumped storage) are not universally defined as renewable in the six New England states. (c) “Other” represents resources using a fuel type that does not fall into any of the existing categories. Other may include new technologies or new fuel types that come onto the system but are not yet of sufficient quantity to have their own category. (d) Tie lines are transmission lines that connect two balancing authority areas. A positive value indicates a net import; a negative value represents a net export. (e) The energy used to operate pumped storage plants. (f) Generation |

|

|---|---|---|---|---|

| Total Generation (a) | 101,303 | 100.0% | 87% | |

| Gas | 55,586 | 55% | 49% | |

| Nuclear | 23,204 | 23% | 20% | |

| Renewables | 12,116 | 12% | 11% | |

| Wind | 3,302 | 4% | 3% | |

| Refuse | 2,681 | 3% | 2% | |

| Wood | 1,787 | 2% | 2% | |

| Solar | 3,851 | 4% | 3% | |

| Landfill Gas | 454 | 0.45% | 0.40% | |

| Methane | 41 | 0.04% | 0.04% | |

| Steam | 0 | 0.0% | 0.0% | |

| Hydro (b) | 9,645 | 10% | 8% | |

| Coal | 182 | 0.18% | 0.16% | |

| Oil | 322 | 0.32% | 0.28% | |

| Price-Responsive Demand | 11 | 0.01% | 0.01% | |

| Other (c) | 237 | .23% | .21% | |

| Net Flow over External Ties (d) | 15,104 | 13% | ||

| Québec | 10,548 | |||

| New Brunswick | 1,945 | |||

| New York | 2,611 | |||

| Pumping Load (e) | 1,679 | -1.46% | ||

| Net Energy for Load (f) | 114,727 | 100.00% |

In 2023, natural-gas-fired generation, nuclear, other low- or no-emission sources, and imported electricity (mostly hydropower from Eastern Canada) provided most of the region’s electricity.

When the wholesale markets opened to competition in 2003, private companies invested billions of dollars in the development of natural-gas-fired power plants because they used advanced technology that made them run efficiently; were relatively inexpensive to build, site, and interconnect; and their lower carbon emissions compared to coal and oil helped the region meet state environmental policies. As nearby shale gas emerged as an inexpensive and plentiful fuel resource around 2008, natural-gas-fired generators became the go-to resource for New England, clearing as the largest resource type in the market year after year. Nearly half of the region’s electric generating capacity uses natural gas as its primary fuel (about 16,000 MW in 2023), and natural-gas-fired power plants produce about half of the grid electricity consumed in a year (about 55,600 GWh in 2023).

In contrast, aging coal-fired, oil-fired, and nuclear power plants have been closing largely because their operating, fuel, and environmental-compliance costs make them too expensive to compete against lower-cost resources. Since 2013, more than 7,000 MW of mostly coal, oil, and nuclear generation have retired or have announced plans for retirement in the coming years.

Competition in the markets brought about this change at a faster pace than under the traditional industry model. Under wholesale markets, private companies have carried the risks of uneconomic investments, not utilities and their customers. Consumers have benefited from this least-cost resource mix created through competitive markets.

The region’s remaining two zero-carbon-emitting nuclear facilities, Millstone and Seabrook, supply a quarter of the electricity New England consumes in a year and will be critical components of a reliable clean-energy grid because they are carbon-free and have a dependable, on-site fuel supply.

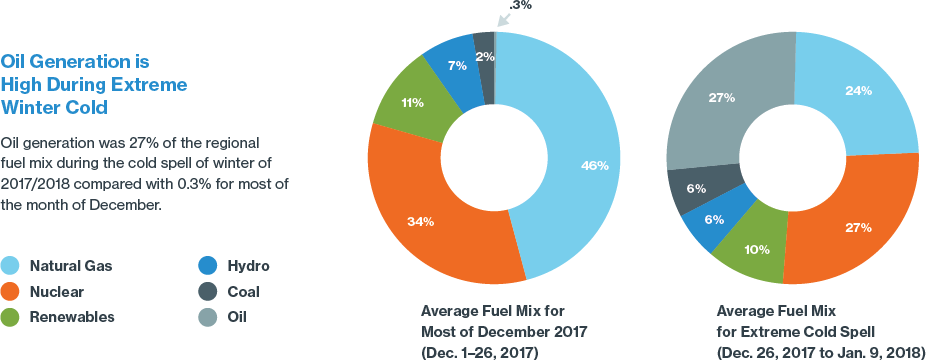

Nuclear, oil, and coal generators are critical on the coldest winter days when natural gas supply is constrained (as shown below). Coal- and oil-fired resources also make valuable contributions on the hottest days of summer when demand is very high or major resources are unavailable. As more and more conventional, thermal generation facilities that store fuel on site retire, the system is increasingly made up of generating facilities that run on “just-in-time” energy sources: natural gas (from pipelines and LNG deliveries), wind, and solar energy.

With limited options for storing natural gas, most natural-gas-fired plants rely on just-in-time fuel delivered to New England through interstate pipelines. However, interstate pipeline infrastructure has only expanded incrementally over the last several decades, even as reliance on natural gas for home heating and for power generation has grown significantly. During cold weather, most natural gas is committed to local utilities for residential, commercial, and industrial heating. As a result, during severe winter weather many power plants in New England cannot obtain fuel to generate electricity. Liquefied natural gas (LNG), brought to New England by ship from overseas, can help fill the gap—but regional LNG storage and sendout capability is limited, and its timely arrival depends on long-term weather forecasts, global market prices, and other logistical challenges.

Winter also poses the greatest challenges for solar output in New England due to snow, clouds, and shortened daylight hours. In addition, shortened winter days means consumers use the most electricity after sunset, and therefore solar doesn’t reduce winter peak demand. While offshore wind experiences its highest production during winter, winter storms that limit solar power can also significantly limit the output of wind generation if high wind speeds force plant operators to shut down in order to protect equipment. This type of variability is a n understandable challenge in meeting the states’ decarbonization goals through greater renewable, weather-dependent technologies, and it poses new technical challenges to the grid’s reliability.

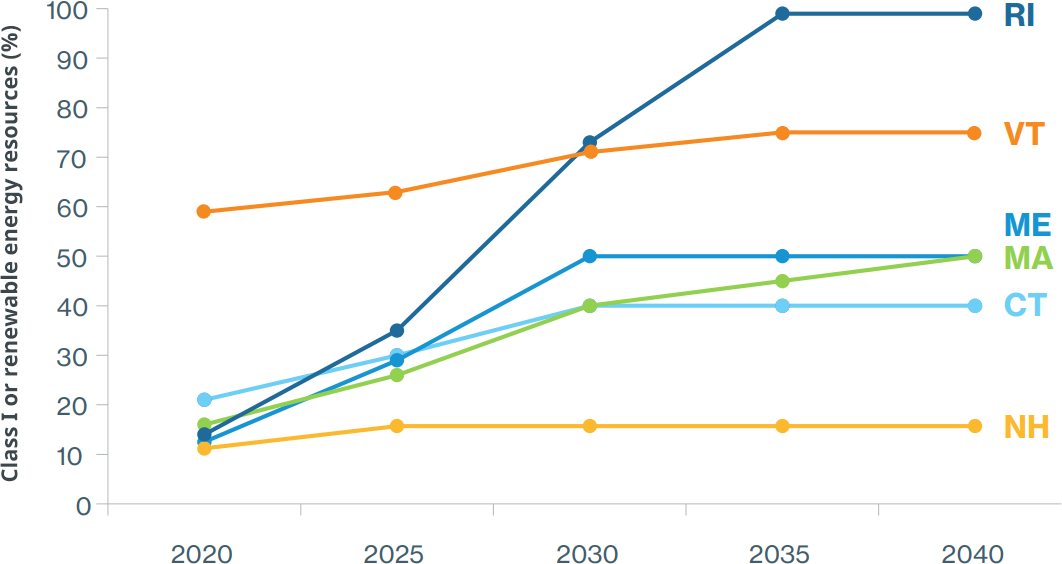

All six New England states have renewable portfolio standards, which require electricity suppliers to provide customers with increasing percentages of renewable energy.

Notes: State RPS requirements promote the development of renewable energy resources by requiring electricity providers (electric distribution companies and competitive suppliers) to serve a minimum percentage of their retail load using renewable energy. Connecticut’s Class I RPS requirement plateaus at 40% in 2030. Maine’s Class I/IA RPS requirement increases to 50% in 2030 and remains at that level each year thereafter. Massachusetts’ Class I RPS requirement increases by 2% each year between 2020 and 2024, 3% each year between 2025 and 2029, reverting back to 1% each year thereafter, with no stated expiration date. New Hampshire’s percentages include the requirements for both Class I and Class II resources (Class II resources are new solar technologies beginning operation after January 1, 2006). New Hampshire’s Class I and Class II RPS requirements plateau at 15.7% in 2025. Rhode Island’s requirement for ‘new’ renewable energy reaches 100% in 2033. Vermont’s ‘total renewable energy’ requirement plateaus at 75% in 2032; it recognizes all forms of new and existing renewable energy and is unique in classifying large-scale hydropower as renewable.

Greenhouse gas reductions are promoted on a state-by-state basis and at the regional level through a combination of legislative mandates and aspirational goals.

With deadlines looming, the states are eager for the quicker transformation of the power grid to renewables and for electrification of the broader economy. Because large-scale renewable resources typically have higher up-front capital costs and different financing opportunities than more conventional resources, they have had difficulty competing in the wholesale markets. Therefore, the New England states are promoting, at varying levels and speed, the development of specific clean-energy resources to meet their public policy goals.

Several states have established public policies that direct electric power companies to enter into ratepayer-funded, long-term contracts for large-scale carbon-free energy that would cover most, if not all, of the resource’s costs. Long-term contracts carry risk given the rapid development and falling costs of new technologies—and this risk of stranded costs is placed back on consumers. As policymakers seek to convert the transportation and heating sectors to electricity to fully meet climate goals, this public policy trend is expected to continue.

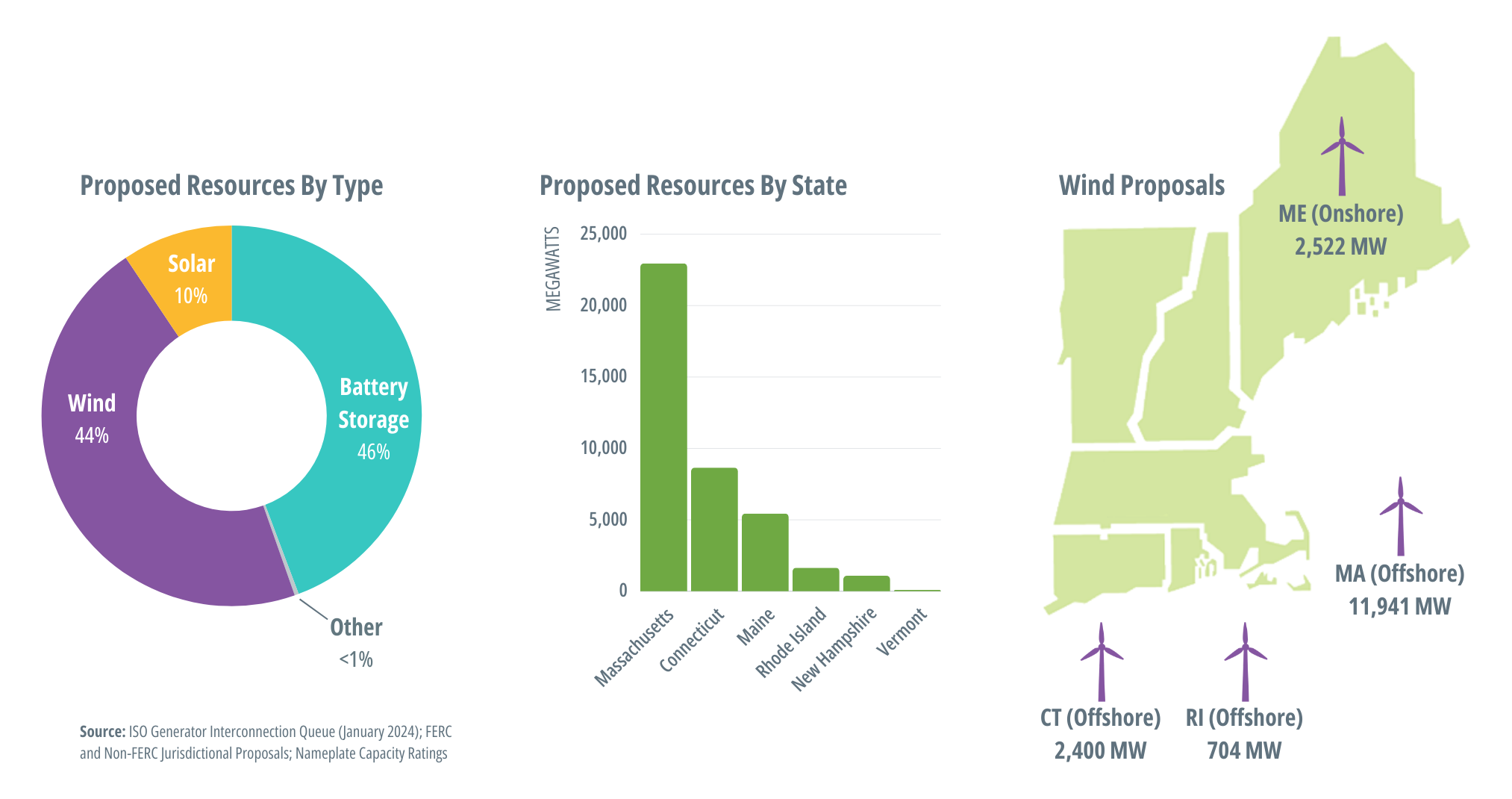

Developers of clean-energy resources are taking advantage of state incentives, declining technology costs, and revenues from the wholesale markets. About 97% of resources currently proposed for the region are grid-scale wind, solar, and battery projects. As of January 2024, about 40,000 MW have been proposed in the ISO New England Interconnection Request Queue.

Source: ISO Generator Interconnection Queue (January 2023); FERC and Non-FERC Jurisdictional Proposals; Nameplate Capacity Ratings

Note: Some natural gas proposals include dual-fuel units (with oil backup). Some natural gas, wind, and solar proposals include battery storage.

New England has enough wind energy to power more than a million homes when all the turbines are spinning, with roughly 1,400 MW of wind power operational in the region—most of it built over the past decade. As of January 2024, wind accounts for about 44% of the projects under interconnection study. The New England coast offers prime conditions for offshore wind, and the bulk of the region’s proposed wind projects are in the waters of Massachusetts, Rhode Island, and Connecticut; most of the remaining projects are proposed onshore in Maine. The turbines at the Block Island Wind Farm came online in 2016, making the 30 MW project the first offshore windfarm in the United States. In January 2024, Vineyard Wind delivered its first power to the New England regional grid during commissioning and testing. Learn more about transmission needed to support a hybrid grid.

![]()

Energy storage represented 46% of the projects in the Interconnection Request Queue as of January, 2024. For more than 40 years, New England has been served by two large-scale pumped-hydro energy storage facilities that can supply almost 2,000 MW of capacity at 10 minutes’ notice. Now, new storage technologies are emerging, driven by technological advances, falling costs, and support from the states, as well as changes to the markets that enable storage participation. Large amounts of new and existing battery storage have cleared in recent Forward Capacity Auctions.

Grid-scale and behind-the-meter energy storage can contribute a number of benefits:

Storage also consumes energy and may not provide assistance once depleted. Energy storage resources draw electricity from the power system or directly from a generating resource (such as a colocated solar or wind facility) as they “stockpile” energy and then send electricity to the grid at a later time. Overall, they consume more energy than they supply, as operations and losses during energy conversion consume some of their “inventory” of stored energy. If these resources are already depleted during a system emergency, they would not be able to provide help but would instead sit idle. This makes their “inventory management” and optimization a key technical challenge for the grid’s reliability.

Solar power accounts for 10% of projects under study in the ISO Interconnection Request Queue as of January 2024. Most solar power in New England, though, is connected to local distribution utilities or “behind the meter” directly at retail customer sites. Because such projects do not follow the ISO interconnection process, they aren’t reflected in the Interconnection Request Queue numbers. The ISO must still track solar power’s growth in the region for forecasting and planning purposes, however, since it reduces demand on the grid. In 2022, behind-the-meter photovoltaics (BTM PV) reduced demand on New England’s bulk electric system by an estimated 3,764 gigawatt-hours (GWh)—enough electric energy to power about 430,000 homes for a year.

The region had a total of about 350,000 distributed solar power installations as of December 2023 with a combined nameplate generating capability of approximately 6,500 MW. Distributed solar includes BTM PV as well as other facilities that participate in the region’s wholesale electricity markets.

As with behind-the-meter solar, energy efficiency (EE) measures can reduce electricity demand from New England’s power grid. New England states invest billions of dollars on EE programs that promote the use of energy-efficient appliances and lighting and advanced cooling and heating technologies (nearly $6.9 billion on EE programs from 2015 to 2021 and another $10.8 billion expected between 2023 and 2032). Massachusetts, Vermont, Maine, Rhode Island, and Connecticut rank among the top 10 states in energy efficiency in the US, according to the American Council for an Energy-Efficient Economy's 2022 rankings.

Unlike EE and behind-the-meter solar, which are passive demand resources, active demand resources (also known as demand-response resources) can be dispatched by the ISO. Demand-response resources can reduce their electricity consumption from the regional grid “on demand” by powering down machines (load management), switching to an on-site generator (distributed generation), or switching to a storage device (batteries). Since June 1, 2018, ISO New England has deployed demand-response resources as part of the energy dispatch and reserve-designation process along with generating resources. Active demand response accounted for 11 GWh of reduced system demand in 2023.

Read about solar power in New England—its growth, locations, and effects on the system, as well as how the ISO is handling related challenges.

Learn about how ISO New England is actively pursuing innovations to help create a more efficient, responsive, reliable system that can handle expanded renewable generation and smart grid technology.