Pillar Three

Energy Adequacy

Pillar three status:

Yellow Trending Green

Risks to energy adequacy could increase if expected renewable resources don’t materialize, needed transmission isn’t built, or fuel supply chains are disrupted.

Staying Prepared

The future grid faces energy adequacy challenges on two fronts. As we’ve seen, electrification of the transportation and heating sectors will drive demand higher and higher in the years ahead. Meanwhile, extreme weather caused by climate change will increasingly affect the productivity of energy resources and could threaten the stability of the grid as a whole. Ensuring that New England has adequate energy will require both responding to increased demand and preparing for low-probability, high-impact weather events.

Over the last three decades, New England’s peak electricity use has always been in the summer. But heating electrification is expected to turn the regional grid back into a winter-peaking system sometime in the mid-2030s. For a number of reasons, energy adequacy concerns are already greatest around periods of prolonged cold, and that will remain true for the foreseeable future.

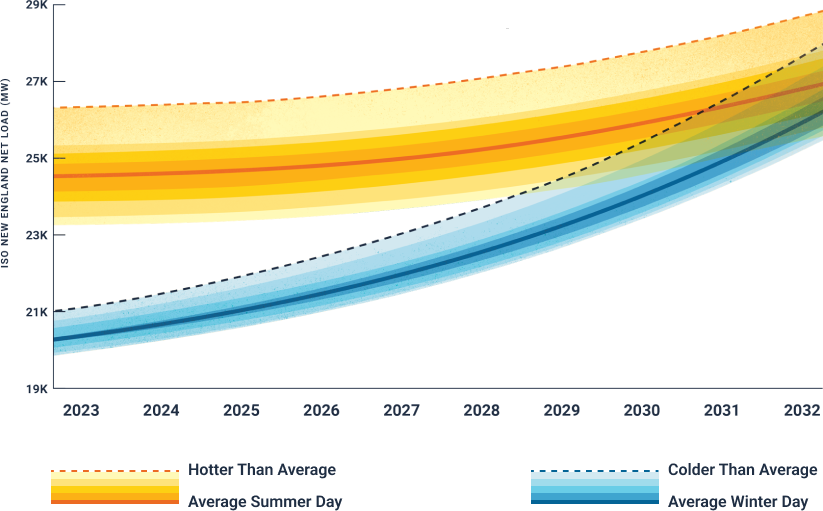

Peak Demand Forecast

New England’s summers have long been more energy-intensive than its winters because more electricity is used for cooling than for heating. But that’s changing, and peak demand is now expected to be higher in winter than in summer by the mid-2030s. That could happen even sooner if the region experiences colder-than-average temperatures.

Keeping fuel in the tank

In the near term, natural gas will remain the region’s leading fuel source for electricity generation. But generators’ access to gas is limited in winter, when more of that resource is dedicated to heating homes and businesses. Access to liquefied natural gas, which the region must import by sea, can also be limited depending on shipping schedules and global economic forces.

The coldest days tend to see greater electricity production from oil because that resource temporarily becomes more economical than gas. During a prolonged cold snap, however, power plants’ supplies of stored fuels—oil as well as coal and liquefied natural gas—could be depleted before new deliveries arrive. Ahead of the winter of 2023/2024, the ISO launched a two-year Inventoried Energy Program to incentivize generators to maintain sufficient levels of stored fuel during winter to guard against situations like this.

On the clean energy side, the growth of solar and wind resources means the functioning of the power grid is becoming more dependent on the weather. These resources can help mitigate risks in the winter months, but the region will need a sustainable solution to withstand wind and solar “droughts.” Recent ISO economic studies of the potential 2040 power system have found that, in the future, the region will still need dispatchable suppliers of electricity—whether or not they are carbon-emitting—to maintain reliability during periods of high winter electricity use. This research suggests that New England’s future grid may lack sufficient natural gas pipeline infrastructure to meet the region’s winter fuel demand for both home heating and power generation, even though these resources may be needed infrequently. Advancements in long-term storage technology will be necessary before batteries can be relied upon to see us through extended periods of energy scarcity—and as discussed in the previous section, batteries may not have adequate opportunity to charge during the winter months. Alternative clean fuels have promise, but are not yet mature.

Staying a step ahead of the weather

The ISO is continually developing and refining tools to address tomorrow’s energy adequacy challenges. These tools include our innovative 21-Day Energy Assessment Forecast and Report, which helps system operators identify potential energy shortfalls while there is time to work with stakeholders to prevent them or lessen their impact. The ISO is analyzing meteorological data in greater detail than ever before to forecast electricity demand, as well as output from solar and wind resources.

In collaboration with the Electric Power Research Institute, the ISO recently conducted an assessment of the potential impacts of extreme weather on power system operations. The first-of-its-kind probabilistic energy adequacy study identified scenarios that could strain the grid over the next 10 years, in addition to studying scenarios suggested by stakeholders. The results indicated the risk of energy shortfall is manageable in the short term, meaning the ISO would use existing tools, such as calling for assistance from neighboring power systems or asking the public to conserve electricity use, in order to reduce the risk or mitigate the impact of an energy shortfall.

Risk does increase through 2032 as demand grows and older resources retire. It’s important to understand that the ISO’s initial assessment—that energy shortfall risk is manageable—is not a guarantee of energy adequacy in the next decade. If key assumptions about the pace of renewable resource additions, transmission build-out, or fuel availability don’t hold, an increasingly risky energy shortfall profile could emerge.

The energy adequacy study gives the ISO a new framework for assessing future scenarios. The framework can be continually updated as the resource mix evolves and weather becomes increasingly unpredictable. This Probabilistic Energy Adequacy Tool will enhance the ISO’s ability to anticipate problems and respond appropriately. The information it provides will inform the ISO as it works with the states and other stakeholders to determine longer-term steps to protect against energy shortfalls and mitigate any risks identified through the study of stakeholder-requested scenarios.

The ISO is using the results of this research to work with stakeholders on a Regional Energy Shortfall Threshold (REST), establishing an acceptable level of energy shortfall risk common to the six states.

Having this measure in place will allow the ISO to take action, evaluating whether specific solutions are needed to help the region maintain the agreed-upon margin. These might include adjustments to market designs, investments in infrastructure, or dynamic retail pricing and additional responsiveness by end-use consumers. Some of these solutions fall under the purview of the New England states, who will be key participants in the regional discussions.