Pillar Two

Balancing Resources

Pillar two status:

Yellow Trending Green

Dispatchable generators, energy storage, demand response,

and a range of services will be crucial to ensure equilibrium

as intermittent resources see swings in energy production.

Managing the Grid, Minute by Minute

New England will eventually harness enough power from the wind and the sun to meet much of its demand for electricity. But these highly variable resources cannot satisfy all of the region’s energy needs, all of the time.

The ISO’s research consistently finds that dispatchable resources—which can include generation, storage, and demand response—will play a vital role throughout the clean energy transition by filling gaps between supply and demand due to swings in production from intermittent, weather-dependent resources. Other assets help balance the system and contribute to reliability by providing services such as voltage and frequency support.

Today, natural gas plants, pumped hydro, and demand response afford the grid much of its needed flexibility. In the future, clean alternative fuels and battery storage could bolster this role. A robust fleet of dispatchable resources will continue to play a role in the decades ahead, and underinvestment in the next generation of balancing resources and services represents a longer-term risk to reliability. Meanwhile, changing patterns of electricity generation and consumption mean these resources and services play an important role in increasingly complex system operations.

Daily patterns are changing

Vast increases in distributed energy resources—primarily small-scale, behind-the-meter solar installations—are coming. These resources are not visible to the ISO control room. Like other weather-dependent resources, they are not dispatchable, and their output changes second by second.

This represents a dramatic change in the daily pattern of how much electricity the grid must supply. The ISO continues to study and plan for the economic and operational realities of a bulk electric system that must be able to work at very low levels of grid demand on sunny spring days, as well as very high levels of grid demand due to electrification.

Behind-the-Meter Solar Reduces Grid Demand

Demand for electricity from the grid plunges during times of high solar production, potentially displacing resources that may be needed in the afternoon and evening and “spilling” electricity produced by clean energy resources that cannot be stored. This raises questions about how to incentivize resources that must be available to ramp up quickly as daylight fades.

This chart uses the example of May 1, 2022—when the ISO saw one of the lowest levels of grid demand on record—to illustrate the potential for increasingly sharp drops and increases in grid demand under similar weather in the future, as behind-the-meter solar meets more of the region’s total demand. The capacity of New England’s nuclear power plants is included to help contextualize the forecasts for grid demand.

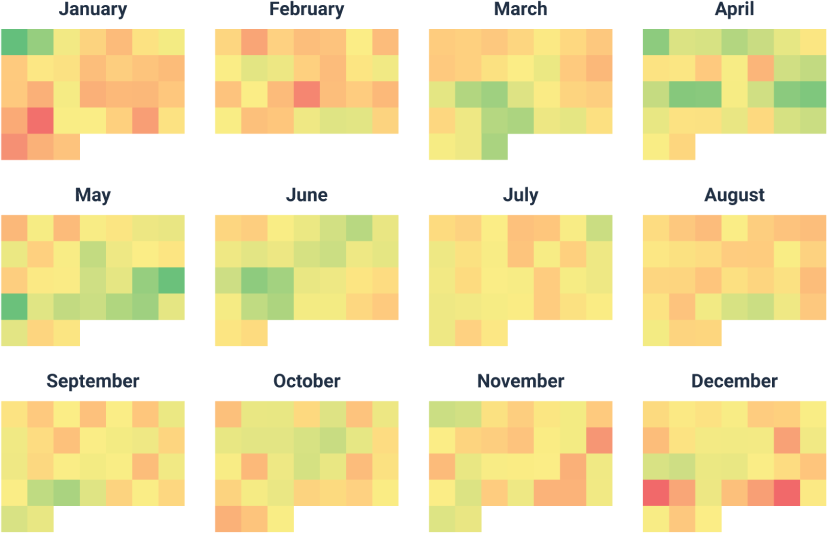

Batteries Could See Charging Challenges in the Future Power System

Energy storage is a key part of our grid’s past, present, and future. Two pumped-storage hydro facilities, capable of quickly delivering 1,800 MW of electricity for eight hours, have operated since the 1970s. The ISO can currently dispatch about 90 MW of short-duration battery storage, and that figure is expected to grow substantially. Our research has found strong seasonal patterns for battery charging cycles in the future. Modeling in the Future Grid Reliability Study found that, under some scenarios in a potential 2040 power system, the battery fleet may be depleted quickly and then struggle to recharge during the winter months. This is a time of year when batteries may be needed most to fill supply gaps during periods of high demand due to cold weather, as well as periods of low production from wind and solar resources. Daily average charge levels remain higher in spring, when demand for electricity from the grid is lower and the region sees significant production from solar installations.

Competitive markets support an evolving grid

New England’s wholesale electricity markets must provide sufficient revenue to resources that run infrequently but are needed to help ensure reliability and bolster energy adequacy. Through this decade and the next, market rules must evolve to accommodate the changing resource mix as well as support the compensation of balancing resources and services that can address steep, sudden swings in demand for grid electricity.

The ISO’s ongoing responsive market design projects, which aim to advance the competitive wholesale markets to support the investment and new services required for a reliable clean energy transition, include:

- Resource Capacity Accreditation in the Forward Capacity Market: A range of resources help the region meet its capacity needs, and they have a range of strengths and vulnerabilities. The RCA project will implement new methodologies to value resources’ unique capacity contributions and characteristics.

- The Day-Ahead Ancillary Services Initiative: Known as DASI, this project creates pricing incentives for specific energy and reserve capabilities needed for reliability as regional supply and demand transform. The project will be implemented in 2025 in the form of an expanded and optimized Day-Ahead Market.

- Evolving capacity market timeframes: The ISO has recommended replacing the Forward Capacity Market, which today secures capacity three years in advance, with a new structure that procures capacity shortly before the delivery period and on a seasonal rather than annual basis.

New England’s wholesale electricity markets have served the region well for two decades, supporting reliability while fostering competitive pricing. But the region’s needs and resources are evolving, and the ISO is working to ensure our tools are evolving, too.