ISO New England runs competitive energy markets where wholesale electricity is bought and sold. The goal of these markets is to provide the region with reliable wholesale electricity at competitive prices. The markets accomplish this goal with two core mechanisms: economic dispatch and uniform clearing price. Here’s how they work.

Every five minutes of every day, ISO New England chooses resources to produce just the right amount of electricity to meet the region’s demand, but we also choose the least expensive resources available to meet that demand. This is called economic dispatch. As electricity demand changes throughout the day, the ISO dispatches resources in economic merit order. Resources submitting the lowest-price offers are dispatched first. As demand increases, higher-priced generators are dispatched with the highest-priced resources dispatched last. As demand decreases, higher-priced resources reduce output in reverse merit order.

Note that “resource” refers to any asset that can participate in the markets, such as a generator, an electricity import, a demand resource—even a virtual trader. Demand resources are assets that help meet electricity needs by reducing their own electricity consumption, thereby freeing up more electricity on the grid for use by others. Virtual traders don’t own any assets and instead trade on financial positions.

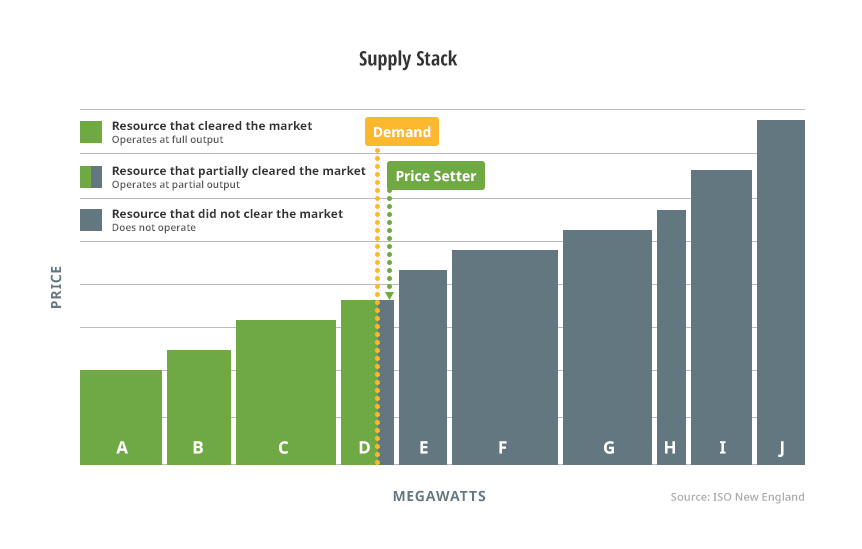

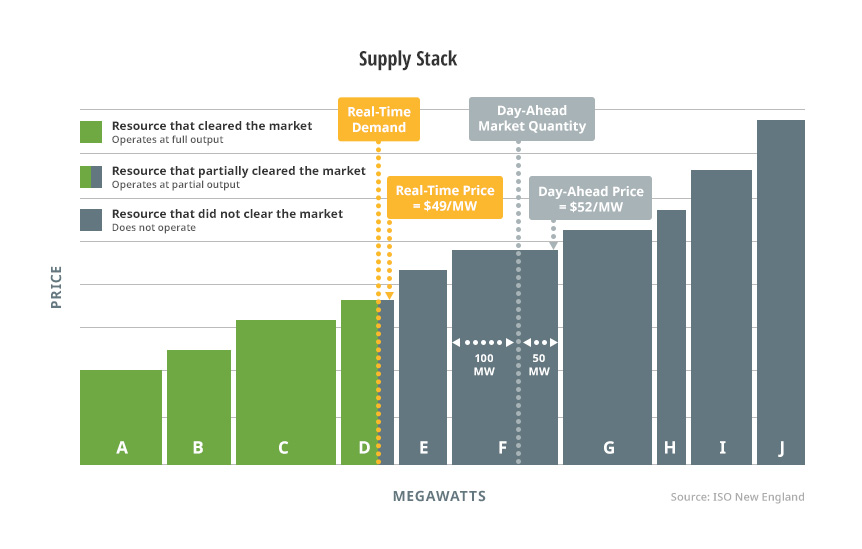

Resource owners tell the ISO how many megawatts of energy they want to sell and for what price, called supply offers. Sophisticated software sorts the supply offers from lowest to highest price, creating the supply stack (sometimes called the bid stack). The supply stack is then compared to the demand for electricity.

In the example below, Resources A–C clear the market (i.e., their supply offers are selected) because they’re offering the least expensive energy needed to satisfy electricity demand. Resource D only partially clears and will be scheduled to operate at less than full output. Resources E–J do not clear at all because lower-priced resources can be used to meet demand.

The energy price to be paid to all resources meeting demand is set by the resource in the supply stack that would satisfy the next increment of energy needed if demand were to increase. This price-setting resource is known as the marginal resource. In the example above, Resource D is the marginal resource or price setter. Every resource that clears the market will get paid Resource D’s price, regardless of the price they asked for in their supply offer. This type of auction is called a uniform clearing price auction, and it’s common in competitive markets where commodities of all types are bought and sold, and is used in all the competitive wholesale electricity markets in the US.

It may be difficult to understand why the same price would be paid to every supplier of the product, no matter how they produced it or how much it cost them to produce it, or even how much they offered to sell it for. Commodities like corn, soybeans, or silver are a good example—each unit is just like the other. And that’s true of electricity—every electron is the same as every other electron in terms of its ability to power the region. The uniform clearing prices recognizes that the value of each unit of a product is the same.

The object of economic dispatch is to minimize the total cost of producing electricity while meeting consumer demand for electricity and keeping the power system in balance.

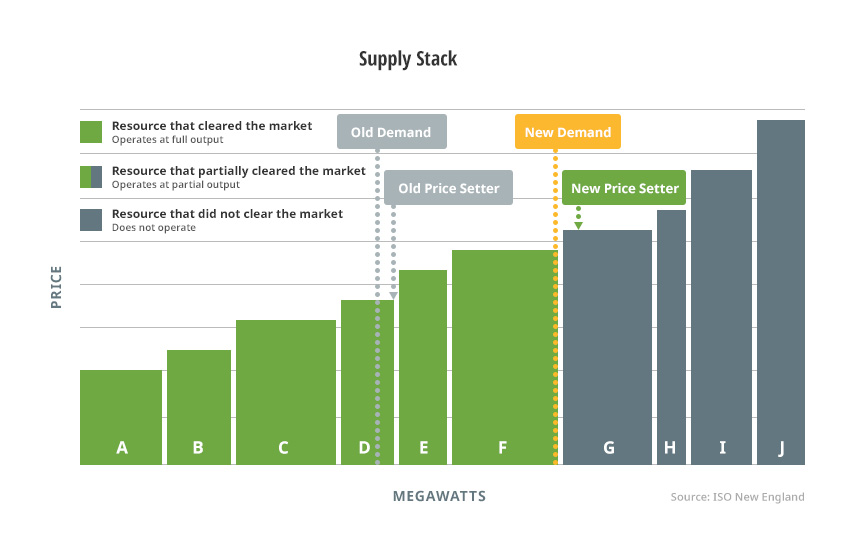

These shifts can change the marginal resource and result in a new uniform clearing price. In the example below, demand for electricity has increased. Now Resource F is the last resource needed to satisfy demand, and Resource G is the marginal resource and sets the uniform clearing price for electricity, despite not having cleared the market.

Credits and charges are ultimately calculated in the market-settlement process. Each seller is paid for their cleared megawatts, while each buyer served is charged for the megawatts purchased—all at the uniform clearing price.

The transactions described above take place daily in New England’s two energy markets where wholesale electric energy is bought and sold. Together, these markets form a multisettlement system: each market produces a separate but related financial settlement.

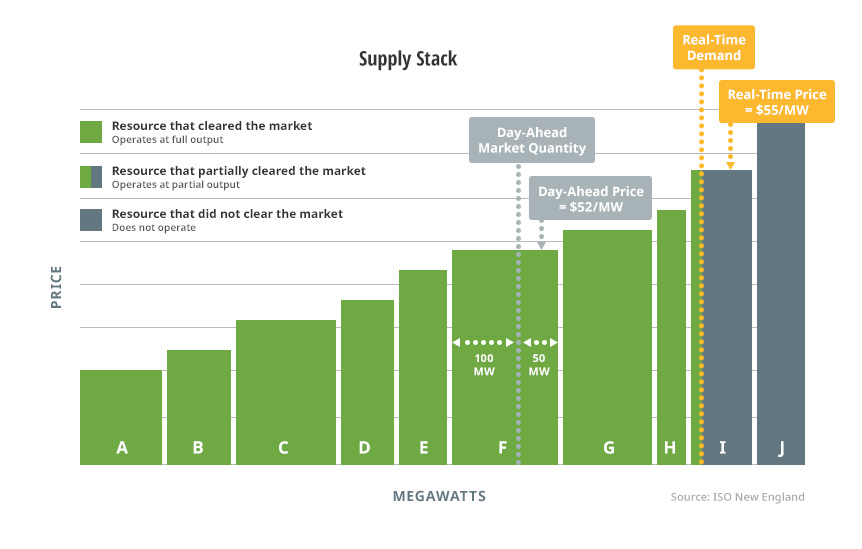

In this example, Resource F cleared 100 MW at $52/MW in the Day-Ahead Energy Market: a $5,200 credit. During the operating day, however, demand was higher and Resource F cleared an additional 50 MW at $55/MW: that’s an extra $2,750 credit. Resources G–I also cleared in real time and would be paid $55/MW.

Conversely, imagine a buyer who purchased 100 MW at $52/MW in the Day-Ahead Energy Market: a $5,200 charge. In real time, say they used an additional 50 MW at $55/MW: that’s an extra $2,750 charge. Their total bill is $7,950—a net savings, considering it would have cost $8,250 to buy all 150 MW at $55/MW in real time.

In this example, Resource F cleared 100 MW at $52/MW in the Day-Ahead Energy Market: a $5,200 credit. But during the operating day, Resource F’s 100 MW were not actually needed, meaning they effectively operated at −100 MW. At the real-time price of $49/MW, this would result in a charge of $4,900. That’s still a net profit of $300.

Conversely, a buyer who purchased 100 MW at $52/MW in the Day-Ahead Energy Market (a $5,200 charge) but only used 50 MW in real time would be credited $2,450 (50 MW at $49/MW). This wasn’t actually a good gamble, though: they paid $150 more in the day-ahead market than they would’ve in real time.

By setting a clearing price that is the cost of the marginal unit, the ISO maximizes competition and supports its goal of providing cost-efficient, reliable electricity to New England’s power grid.

The examples above provide a simplified way to understand how the markets work. In reality, the ISO manages market clearing and settlement for hundreds of market participants at hundreds of distinct clearing prices every day of the year. Prices can vary:

Sometimes, the ISO has to dispatch power resources out of economic merit order to ensure the reliability of the power system. One example would be running a resource to maintain voltage in a load pocket within the range prescribed by federal reliability standards. Read FAQs: Net Commitment-Period Compensation (NCPC) to learn how resources are paid in these situations.