Net Commitment Period Compensation (NCPC) is the payment to a market participant for its generator, dispatchable-asset-related demand (DARD), demand-response resource (DRR), or external transaction that did not recover its effective offer costs from the energy market during an operating day. The NCPC payment is intended to make a resource that follows the ISO’s operating instructions “no worse off” financially than the best alternative generation schedule. Typically, a resource receiving NCPC was operated out of merit to protect the overall resource adequacy and transmission security of specific locations or of the entire balancing authority area.

Note: Coordinated external transactions are excluded from the NCPC charge calculations.

Resources earn special-case NCPC credits in a number of limited situations, which include cancelled starts, resource posturing, imports and exports (including virtual transactions) in the day-ahead and real-time markets, and hourly shortfall for the cancellation of a real-time commitment of a day-ahead-committed generator available for operation.

NCPC credits associated with most special-case NCPC are allocated to the charge category associated with the reason for the resource commitment. (See What are the different types of NCPC credit? and How are NCPC charges allocated?)

Resource-posturing NCPC is allocated to market participants pro rata on real-time load obligation, excluding the real-time load obligation associated with dispatchable-asset-related demand and the real-time load obligation associated with coordinated external transactions.

Day-ahead market import transaction NCPC is allocated to market participants pro rata on day-ahead load obligation at the applicable external node. Day-ahead export transaction NCPC is allocated to market participants pro rata on day-ahead generation obligation at the applicable external node. (See Are NCPC costs allocated to day-ahead external-transaction activity?)

Market participants that submit physical or virtual day-ahead external transactions can be subject to specific NCPC charges. If the total of the transactions submitted at an external node exceeds the total transfer capability (TTC) of that node in the hour, available counterflow will be cleared to allow the transactions to flow. The NCPC payments for the counterflow transactions are allocated solely to the market participants with cleared transactions at the node, pro rata on the transaction amount.

The table below provides an example.

Although this example shows fixed transactions at Node X, the counterflow can be cleared for transactions submitted at any price. For priced transactions, the counterflow price cannot exceed the transaction price. For fixed transactions, the price of the cleared counterflow is not limited; available counterflow will be cleared in price order, up to the necessary quantity, to allow the submitted transactions to flow.

This example also applies to import transactions; counterflow will be cleared to allow import transactions to flow if the transactions exceed the import TTC at an external node.

Note: Cleared counterflow in the Day-Ahead Energy Market does not apply at an external node where coordinated transaction scheduling (CTS) has been implemented. Instead, the LMP at the CTS location includes congestion costs that reflect the binding constraints at the external node. For example, a fixed day-ahead market import at the CTS location could settle at a negative locational marginal price, resulting in a charge for the day-ahead market import.

The Net Commitment-Period Compensation (NCPC) cost for an asset comprises the following components:

A participant can submit an asset’s bid for its incremental energy cost in two different ways:

The following examples show the incremental energy cost calculation for an asset using each of the methods.

Bid Parameters:

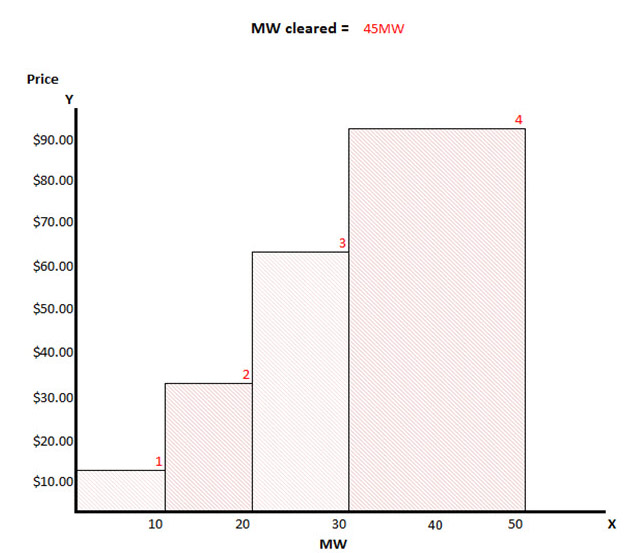

| Bid Block | MW | Price ($/MWh) | Cleared MW |

| 1 | 10 | $10.00 | 45 MW |

| 2 | 20 | $30.00 | |

| 3 | 30 | $60.00 | |

| 4 | 50 | $90.00 |

The total energy cost for the asset is the sum of area for each bid block shown in the above graph.

| Bid Block | MW | Price ($/MWh) | Incremental Energy Cost ($) |

| 1 | 10 | $10.00 | $100.00 |

| 2 | 20 | $30.00 | $300.00 |

| 3 | 30 | $60.00 | $600.00 |

| 4 | 50 | $90.00 | $1,350.00(a) |

| Total Incremental Energy Cost | $2,350.00 | ||

(a) The amount is the product of the remaining 15 MW that cleared and the $90.00/MWh bid price.

Bid Parameters:

| Bid Block | MW | Price ($/MWh) | Cleared MW |

| 1 | 10 | $10.00 | 45 MW |

| 2 | 20 | $30.00 | |

| 3 | 30 | $60.00 | |

| 4 | 50 | $90.00 |

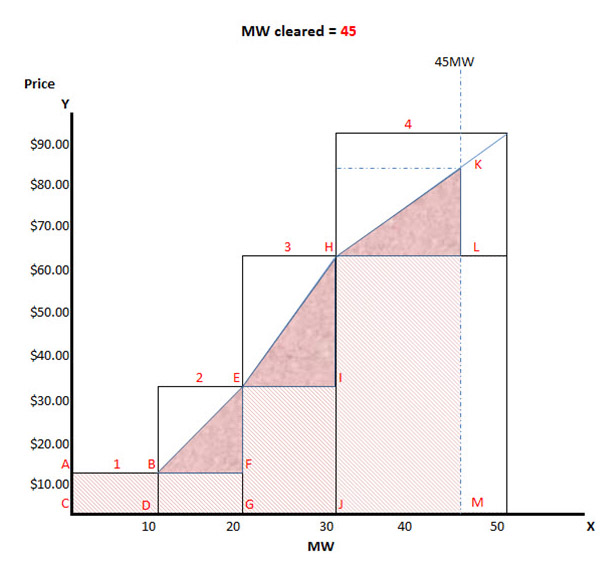

The total energy cost for the asset is the sum of area for each bid block under the slope, shown in the following graph:

Calculation

Calculate area for Block 1 (ACBD):

Area = 10 MW * $10 = $100

Calculate area for Block 2:

Area for the second block is the sum of the area of ☐ BDGF and Δ BEF.

Area of ☐ BDGF = 10 MW * $10 = $100

Area of Δ BEF = (½ * 10 MW * $20) = $100

Total area for the block = $100 + $100 = $200

Calculate area for Block 3:

Area for the third block is the sum of the area of ☐ EGJI and Δ EHI.

Area of ☐ EGJI = 10 MW * $30 = $300

Area of Δ EHI = (½ * 10 MW * $30) = $150

Total area for the block = $300 + $150 = $450

Calculate area for Block 4:

Area for the final block is the sum of the area of ☐ HJML and Δ HKL.

Area of ☐ HJML = 15 MW * $60 = $900

To calculate the area of ∆ HKL, first calculate the slope of line HK and the price point for 45 MW (K)

Slope (M) = (Y2 − Y1) / (X2 − X1)

Where:

X1 = MW point of the previous bid block

X2 = MW point of the current bid block

Y1 = Price point of the previous bid block

Y2 = Price point of the current bid block

Slope (M) = (90 − 60) / (50 − 30) = 1.5

Price (Y2) = (X2 − X1) * (M) + Y1

Price (Y2) = (45 − 30)* 1.5 + 60 = $82.50

Area of Δ HKL = (½ * 15 MW * $22.50) = $168.75

Total area for the block = $900 + $168.75 = $1,068.75

Thus the total incremental energy cost for the asset = $100 + $200 + $450 + $ 1,068.75 = $1,818.75

The same results can also be achieved by using the following formula or by entering the bid information in the interactive table. A static version of the table is below for reference.

[((X2 – X1) * (((X2 – X1) * (M) + Y1 ) – Y1))/2 + ((X2 – X1) * Y1)]

| Block | MW to Calculate | X1 | Y1 | X2 | Y2 | Slope | Incremental Energy Cost |

| 1 | 45 | N/A | N/A | 10 | 10 | N/A | $100.00 |

| 2 | 45 | 10 | $10.00 | 20 | $30.00 | 2 | $200.00 |

| 3 | 45 | 20 | $30.00 | 30 | $60.00 | 3 | $450.00 |

| 4 | 45 | 30 | $60.00 | 50 | $90.00 | 1.5 | $1,068.75 |

| Total Incremental Energy Cost | $1,818.75 | ||||||