The FAQs in this section do not address all issues and requirements of these policies, and participants are urged to consult these documents for additional information. In case of any discrepancy between the answers to these FAQs and the policies, the policies govern.

ISO New England accepts three forms of financial assurance:

The ISO processes new letters of credit and LC amendments, which have met all requirements, as follows:

All new or amended Letters of Credit may be electronically submitted to creditdepartment@iso-ne.com for processing provided a hard copy original is received by Market and Credit Risk on the next business day.

The mailing address is:

ISO New England

One Sullivan Road

Holyoke, MA 01040

Attn: Market and Credit Risk

Yes. All Letters of Credit must conform to the Federal Energy Regulatory Commission (FERC) approved ISO NE template.

The Eligible Letter of Credit Bank list includes those Chicago Mercantile Exchange (CME) approved Letter of Credit Banks /or ISO approved banks.

Yes. A Letter of Credit can be issued on a company’s behalf. However, the companies must be affiliates of one another.

Per the Financial Assurance Policy (FAP) the account party on a letter of credit must be either the Posting Entity whose obligations are secured by that letter of credit or an Affiliate of that Posting Entity.

Material changes to the approved template language must be brought before the NEPOOL Budget & Finance Subcommittee. There is a $1,000 fee associated with this process. The fee will be billed on the next non-hourly invoice.

In lieu of an expiration date, evergreen language is available upon request. The insertion of the ISO approved evergreen language is a non-material change that is not subject to the $1,000 change fee mentioned above.

Typically processing of a new or revised Letter of Credit will take up to four (4) days. However, it may take less or more time depending on the circumstances.

Yes. There is no limit to how many Letters of Credit may be issued. However, there is a limit to how much a single bank may issue to any one company. The current limit is set to $100M.

In order to renew a current Letter of Credit an original amendment for extending the expiration date must be received prior to the Letter of Credit being set to zero. Per the Financial Assurance Policy the Letter of Credit will be valued at $0 30 days prior to the stated expiration date:

“An irrevocable standby letter of credit provides an acceptable form of financial assurance to the ISO. For purposes of the ISO New England Financial Assurance Policy, the letter of credit shall be valued at $0 at the end of the Business Day that is 30 days prior to the termination of such letter of credit.”

At the same time the expiration date is extended you must verify the language of the Letter of Credit matches the current template. An amendment to extend the Letter of Credit will not be accepted if the language does not conform to the current template provided.

In lieu of an expiration date, the ISO approved evergreen language is available upon request.

To change the amount of an existing Letter of Credit, the issuing bank is required to send an original amendment to Market and Credit Risk indicating what the new amount the Letter of Credit is.

To cancel a Letter of credit the Issuing Bank is required to send an original amendment canceling the Letter of Credit.

Yes. The current cap for Letters of Credit issued by a single bank to a group of affiliated entities is $150M. If companies become affiliated after a bank has issued Letters of Credit that exceed the $150M cap, those companies will be notified by ISO Market and Credit Risk and will have five (5) business days to rectify the situation with new Letters of Credit.

No. Each Market Participant must have their own Letter of Credit in place for Financial Assurance. Letters of Credit may not be divided up or shared among multiple entities.

All questions and inquiries may be submitted via the Ask ISO system located at: https://askiso.iso-ne.com/s/ or by contacting Customer Service at custserv@iso-ne.com or by phone at 413-540-4220.

As explained above, the participant will be required to maintain sufficient financial assurance to keep its credit test percentage at 90% or less. In addition, under the currently effective Financial Assurance Policy, the participant will be charged a $1,000 penalty for each default event subsequent to the issuance of the fifth default notice in a 12-month rolling period.

The ISO’s full Financial Assurance Policy is available on line.

A web-based training is available that explains the calculation of Financial Transmission Rights and the requirements for virtual financial assurance within the ISO New England market. Approximate viewing time is 29 minutes.

Another web-based training is available on FCM financial assurance requirements. Approximate viewing time is 35 minutes.

Section III.B of the Financial Assurance Policy (which is Exhibit IA of the ISO’s Transmission, Markets, and Services Tariff) and Section 3.7 of the Billing Policy (which is Exhibit ID of the tariff) describe the suspension process. Section B.3 of the FAP basically states that a suspended market participant cannot participate in the ISO markets. The suspension could result in the following actions:

However, the ISO still would be able to invoice or collect payment for any amounts the suspended participant owed.

Additionally, any load asset registered to a suspended market participant would be terminated, per the conditions detailed in the FAP. Participants suspended from entering into future FTR transactions can retain all FTRs it holds but cannot acquire additional FTRs during the suspension. The policies contain additional details and conditions of these suspensions.

The participant must contact its company's designated security administrator (SA), who must make the requisite changes in the Customer and Asset Management System. The ISO’s Customer Support, at (413) 540-4220 or custserv@iso-ne.com, can assist a participant in determining its company’s SA and can assist the SA with the process.

The data are contained in the DALMP Congestion Component Report. The report contains a 36-month history of the monthly average congestion component of the day-ahead LMPs, by node, for on-peak and off-peak hours.

The proxies are available the first day of the month proceeding the applicable FTR auction month.

These proxies are contained in the Day-Ahead Virtual Bid Proxy Report. The ISO Credit Department uses virtual proxies to calculate financial assurance requirements for virtual bid transactions. Proxies are derived from historic day-ahead and real-time LMP spreads by node for on-peak and off-peak hours.

The proxies are available on the 22nd of the month preceding the operating month to which the proxies apply.

ISO New England does not segregate financial assurance by any specific market. However, posted financial assurance (cash or letter of credit) is allocated first to the Market Credit Test, then to the FTR Credit Test, and lastly to the Transmission Credit Test. The allocation occurs for up to three rounds, provided excess financial assurance remains after each of the first two rounds. The first round of allocation brings each credit test to 99.99%, the second round brings each credit test to 89.99%, and the last round brings each credit test to at least 79.99%. If excess financial assurance remains after the third round, the ISO allocates the excess to the Market Credit Test, thereby bringing that test below 79.99%.

Participants choosing to use cash as collateral for their financial assurance obligations must open a BlackRock investment account. Account holders may choose investment options from a predetermined list, and ISO New England must be the beneficiary of the account.

At times, a participant may not be able to increase other forms of collateral in a timely manner. A BlackRock account can provide a means of posting collateral relatively quickly.

Balances and interest are available via the following:

Participants must send requests to withdraw or transfer money via e-mail directly to the ISO’s Market and Credit Risk Department at CreditDepartment@iso-ne.com.

The ISO processes BlackRock withdrawal requests it receives in the morning by close of business the same business day and withdrawal requests it receives in the afternoon by noon the next business day.

The FAM is an external-facing user interface that reflects a company’s credit standing with the ISO. FAM credit data are updated five times per day on business days, as follows:

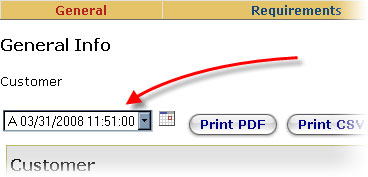

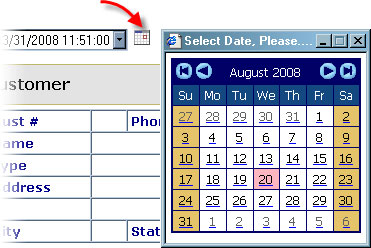

The FAM user interface has a main toolbar across the top of its webpage. Each tab on the tool bar provides access to a company’s vital financial assurance information. Users may select credit information from any update time by using a drop-down date and time selector in the top left-hand corner of the general tab of the user interface.

Participants can view credit data from a point in time other than the last update using the date/time selector and calendar.

The FAM User Guide illustrates additional information in the FAM’s user interface for viewing financial assurance positions.

A participant must contact its company's designated security administrator, who must request ISO Customer Services to grant access. ISO Customer Services, at (413) 540-4220 or custserv@iso-ne.com, can assist a participant in determining its company’s SA.

A participant must contact its company's designated security administrator, who must make the requisite changes in the Customer and Asset Management System. ISO Customer Support, at (413) 540-4220, can assist a participant in determining its company’s SA.

No it does not need to be notarized.

Yes. Attachment 4 and all required supporting documents must be submitted in order to become an active member.

No. The supporting documentation will not be counted towards satisfaction of the customer’s total financial assurance.

A. No. Customers are only required to submit this form once. However, if there is any change that renders the certification inaccurate, the customer must immediately inform the ISO.

Yes. Attachment 4 is a requirement for all new applicants.

Yes. Check all that apply.

Send the completed Attachment 4 to the Market and Credit Risk Mailbox – Creditdepartment@iso-ne.com

No. The Form MUST remain in the original PDF format when uploaded. Additionally, you cannot upload a scanned or copied version of the Form. The Form will be rejected if uploaded in any other format or version than the original. It is recommended to download and save the form to your computer and open with Adobe Acrobat and use the Fill & Sign tool. A digital signature is acceptable. Important: Do Not Use DocuSign as this will disable the form and it will not be in the correct format.

Senior Officer as defined by the Tariff is “an officer of the subject entity with the title of vice president (or similar office) or higher, or another officer designated in writing to the ISO by that officer.”

The Senior Officer must have the authority to sign on behalf of the Certifying Entity.

If the Senior Officer signing on behalf of Certifying Entity is not a vice president or higher and the Certifying Entity wishes to designate another officer, then a letter to the ISO confirming such authority must be provided.

Predecessor is a person or an entity. One example may be if an entity filed for bankruptcy and ceased operations, and its principals had a previously inactive entity that began operating substantially the same business. The determination of Predecessor is fact specific based on the factors contained in the definition.

Mike Roberts – Manager, over 40 years experience in wholesale markets having held positions at Nstar Electric and Downeast Power. Sat on several NEPOOL committees throughout career.

Tim Smith – Manager, over 25 years experience in wholesale and retail markets while with XYS Company.

While you can provide a resume, this is not necessary or what the ISO is looking for. The relevant information can be more efficiently disclosed by listing each Principal and their relationship with the Certifying Entity and their previous experience related to participation in North American wholesale or retail energy (See FAQ Question 3 above). If there is no previous experience to report you MUST note this on the form so that ISO knows the answer is complete, otherwise the form will be rejected.

Energy Markets: such as oil, natural gas & LNG, NGLs, power, coal, freight, and environmental

Exchanges: such as Chicago Mercantile Exchange, Intercontinental Exchange, Nodal Exchange and New York Stock Exchange.

Maybe, The definition of Personnel, contained in Footnote 3, only requires disclosures regarding former Personnel if the triggering event was when such Personnel was employed by Certifying Entity and the person otherwise meets the definition of Personnel (i.e., person was responsible for decision making regarding Certifying Entity’s transaction of business in the New England Markets, including, without limitation, decisions regarding risk management and trading, or any person, current or former, with access to enter transactions into ISO systems). For example, if an employee was involved in material litigation because of alleged market manipulation in wholesale energy markets while such person was employed by Certifying Entity, but has since left the company, such litigation must be disclosed.

No, if the referred matter did not result in a sanction or is not subject to an ongoing material investigation.

Pursuant to Section II.A.1(a) the FAP, you are not be required to disclose information required by Attachment 6 if such disclosure is prohibited by law; provided, however, if the disclosure of any information required by Attachment 6 is prohibited by law, then customer or applicant shall use reasonable efforts to obtain permission to make such disclosure.