Turning Points

Turning Points

Notable Developments

Notable Developments

Thomas Edison receives patent for incandescent light bulb

First complete electric power system launches in New York City

Local networks spring up across US, run by vertically-integrated private or municipal utilities providing power generation, transmission, and distribution; networks begin to interconnect

Federal Power Act of 1920 establishes Federal Power Commission to regulate interstate aspects of electric power and natural gas industries

On November 9, vulnerability of interconnected networks to local power failures is highlighted when a single transmission-line relaying failure near Toronto sets off Great Northeast Blackout, leaving 30 million customers over eight states without power

New England Power Pool (NEPOOL) created to establish central dispatch of generation in New England; handle settlements and billing; coordinate outages of transmission and generation equipment; undertake joint planning and other measures to improve system reliability and economics

Congress reorganizes Federal Power Commission as Federal Energy Regulatory Commission (FERC)

The vertically-integrated utility model leads to a lack of competition within the industry

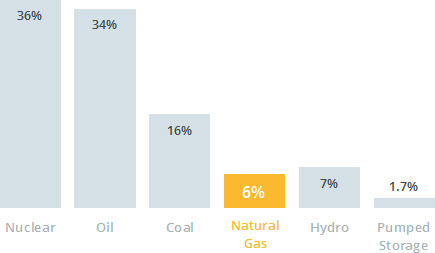

Nuclear, oil, and coal dominate electricity production in the region

Energy Policy Act of 1992 creates new category of electricity producer, exempt wholesale generator (exempt from certain financial and legal restrictions in Public Utilities Holding Company Act of 1935), opening door for greater numbers of power producers; and allows FERC to open up national electricity transmission system to wholesale suppliers

Deregulation (“market restructuring”) begins when FERC Orders 888 and 889 open transmission systems to fair and nondiscriminatory access and remove obstacles to competition in wholesale trade of electricity; in response, NEPOOL proposes the Independent System Operator (ISO) for New England

ISO New England (ISO) created to operate regional power system, implement wholesale markets, ensure open access to transmission lines

About 40 private and municipal utilities generate and deliver electricity in New England

ISO launches regional wholesale electricity markets to expand competitive market forces in regional generation and sales of wholesale electricity—an essential step in supporting competitive wholesale and retail pricing; change ushers in new era of industry innovation

About 200 market participants buy and sell electric power and related products annually in ISO-administered wholesale electricity markets

FERC Order No. 2000 encourages voluntary formation of Regional Transmission Organizations (RTOs) to administer transmission grid regionally throughout North America, and delineates twelve required characteristics and functions

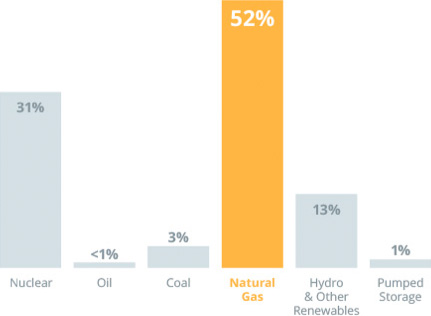

Regional shift to natural-gas-fired generation underway, largely due to natural gas generators being relatively easy to site and less expensive to build than other generation types, plus boom in natural gas production from nearby Marcellus shale

ISO and NEPOOL transmission providers prepare first regional transmission plan summarizing results of reliability and economic-related studies, generator studies, and other transmission projects; process develops into current Regional System Plan

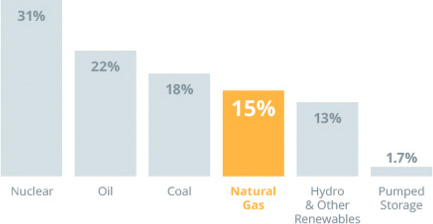

Nuclear, oil, and coal still dominate, but natural-gas-fired generation is coming on line quickly

ISO launches first demand-response programs to compensate resources for helping reduce demand on power grid

100 MW of demand resources participate in New England markets

ISO launches market redesign with locational pricing, day-ahead and real-time markets to more accurately reflect cost of wholesale power and provide clearer economic signals for infrastructure investment (view press release)

In August, New England largely spared from blackout that affects 50 million in Midwestern and Northeastern United States and Canada; sound operation practices and high-quality system operator training credited

34% increase in new plants (about 10,000 MW) since 1999 significantly improves reliability and genuine competition

Cold snap sets winter peak demand of 22,818 MW on January 15, 2004

Over 260 market participants buy and sell electric power and related products annually in ISO-administered wholesale electricity markets

Natural gas fuels 30% of region’s electricity

ISO begins operation as a Regional Transmission Organization (RTO), assuming broader authority over day-to-day operation of region’s transmission system and greater independence to manage region’s electric power system and competitive wholesale electricity markets

ISO launches new Regulation Market designed to more efficiently and precisely price regulation service based on generator availability and use

Close to 500 MW of demand resources participating in New England markets

Following Regional System Plan—ISO’s “roadmap” of system needs started in 2001—infrastructure upgrades well underway in New England, with 75 projects placed in service, totaling $217 million in transmission investment

ISO launches locational Forward Reserve Market for better valuation of reserves to reflect where demand is heaviest, thereby providing price signals for investment in local quick-start plants

Heat wave pushes demand to all-time peak of 28,130 MW on August 2, 2006

Over 280 market participants buy and sell electric power and related products annually in ISO-administered wholesale electricity markets

In February, ISO holds first auction in new Forward Capacity Market (FCM), designed to purchase enough qualified resources three years in advance to satisfy region’s future needs and allow enough time to construct new capacity resources

Over 400 market participants buy and sell electric power and related products annually in ISO-administered wholesale electricity markets

Over 200 transmission projects placed into service, totaling more than $1 billion in investment since 2002

First FCM capacity commitment period begins (one-year period from June through May for which supply obligations were assumed through a Forward Capacity Auction)

ISO embarks on Strategic Planning Initiative (SPI) to define challenges affecting performance of power system resources and long-term power grid reliability

Over 450 market participants buy and sell electric power and related products annually in ISO-administered wholesale electricity markets

Dependence on natural gas challenge #1 for region, as identified by Strategic Planning Initiative

FERC Order 1000 requires cost of transmission solutions chosen to meet transmission needs between neighboring regions to be allocated fairly; expands other transmission planning requirements, including evaluating possible transmission alternatives

ISO finalizes development of new annual long-term, multi-state energy-efficiency (EE) forecast—nation’s first—to better inform future system planning efforts, projecting regional annual average energy savings of 1,358 gigawatt-hours in period of 2016–2022; see current EE forecast

Despite increasing generation, annual air emissions down by 92% for SO2, 66% for NOX, 21% for CO2 versus 2001, due mainly to new, efficient, and cleaner-burning natural-gas-fired power plants and emission controls on region’s fossil-fuel-fired power plants

Natural gas fuels 52% of regional generation

In May, ISO implements Strategic Planning Initiative-related changes to Day-Ahead Energy Market to better align timing of region’s electricity and natural gas markets

In June, ISO marks successful completion of Synchrophasor Infrastructure and Data Utilization (SIDU) project, a high-tech advancement in grid monitoring and evaluation

As anticipated by Strategic Planning Initiative challenge #2, retirements announced for several of region’s largest and typically oldest generators, representing loss of about 3,300 MW since 2011

Natural gas pipeline constraints in winter contributing to under-performance by gas-fired generators, price spikes, and precarious operating conditions (view press release)

Some annual air emissions rise versus 2012 as higher-emitting units run more often to make up for decreased natural gas-fired generation and to serve weather-related peak demand (read more)

ISO launches first annual 10-year forecast of regional solar photovoltaic (PV) resources to better understand impact of increased amounts of distributed generation on grid operations and future grid planning

Hourly supply offers and negative offers go into effect in energy market to help create more accurate wholesale power pricing among other benefits (view press release)

Wind power is 1.8% of annual regional generation, outpacing generation with a fossil fuel for the first time (oil at 1.6%)

Vermont Yankee Nuclear Power Station, one of region’s largest zero-emission generators at 604 MW, ceases operations, contributing to uptick in air emissions; resource retirements challenge accelerates

Redesigned Regulation Market is launched to meet FERC requirements to adjust compensation mechanisms and expand participation to new technologies (read more)

Pilgrim Nuclear Power Plant, another of region’s largest generators at 677 MW, announces plans to close by June 1, 2019, as non-gas-fired generating capacity in region continues to decline

ISO enables electronic dispatch of region’s wind and intermittent hydro resources; they become eligible to set real-time wholesale electricity prices

In December, nation’s first offshore wind farm begins operation off Rhode Island and region’s first grid-scale battery storage goes on line

In December, nation’s first offshore wind farm begins operation off Rhode Island and region’s first grid-scale battery storage goes on line

Lowest average annual energy market prices since 2003 and a 44% decrease in average price of wholesale electricity compared to 2004 (first full year of redesigned energy market) thanks to mild weather and very low natural gas prices

ISO celebrates 20th anniversary of service to New England

Five-minute settlement begins in the real-time energy and reserves markets, replacing hourly settlement

Proposed new wind projects dominate the ISO Interconnection Request Queue for first time

Natural gas pipeline constraints in winter again contribute to price spikes and precarious operating conditions (view article)

Natural gas pipeline constraints in winter again contribute to price spikes and precarious operating conditions (view article)

The ISO releases its first-of-a-kind Operational Fuel Security Analysis, which analyzes the potential impacts on wintertime grid reliability of different possible combinations of future generating resources and fuel mixes

On June 1, the ISO completes a complex, years-long effort to fully integrate active demand resources into the regional wholesale electricity marketplace with implementation of a price-responsive demand (PRD) framework

Also on June 1, pay-for-performance (PFP) incentives go into effect to promote investments by power resource owners to ensure their facilities are able to meet their obligations to provide energy and reserves or reduce demand during times of stress on the regional power system

To accommodate the New England states’ support of clean-energy resources, the 13th Forward Capacity Auction included the first substitution auction where resources interested in retiring can trade their capacity supply obligation to new state-sponsored resources that didn’t clear in the primary auction.

The ISO issued its first request for proposal to solicit competitive transmission solutions under FERC Order 1000. The competitive solutions will address transmission system upgrades needed in the Boston area with the coming retirement of the Mystic Generating Station—one of the largest power plants in New England and located in the region’s largest city.