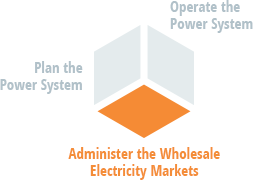

Designing, administering, and overseeing the region’s competitive wholesale electricity markets is one of three critical roles ISO New England performs in the region.

While electricity is a basic necessity, it is also a commodity — a product that is produced, sold, and transported for profit by hundreds of companies. And like most commodities, electricity is sold on both a wholesale and retail level. In New England, wholesale electricity is bought and sold two ways:

The region’s wholesale markets work together to ensure the constant availability of competitively priced electricity for the region’s 15 million residents. Hundreds of companies participate in these markets, buying and selling billions of dollars’ worth of electric power and related products annually. The ISO’s financial independence from companies doing business in the marketplace is crucial to making sure these markets are fair and competitive.

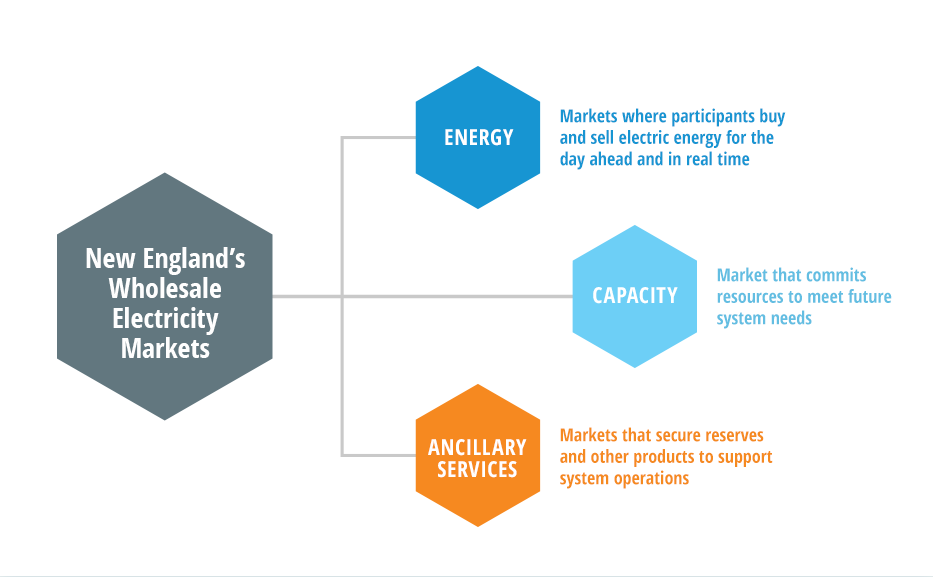

The products traded in New England’s wholesale electricity markets comprise three major categories:

View market facts and stats in our Key Grid and Market Stats section. Follow real-time market data on ISO Express.

The core product bought and sold in the energy markets is electric energy. Power plants generate and sell the energy. Electric utilities or suppliers buy it wholesale in the market and sell it to retail consumers. This is the electricity you buy from your local utility or an independent supplier and use at your home or business. New England has two wholesale electric energy markets:

Participants can choose to participate in one or both markets. They may also engage in bilateral trading outside the markets through contracts to buy and sell electric energy. Participants can use all three trading opportunities to manage their daily production and delivery of wholesale electricity throughout New England and to manage their portfolios as efficiently as possible.

Market participants can also buy or sell financial instruments called Financial Transmission Rights (FTRs). FTRs enable market participants to hedge against the cost of transmission network congestion and provide a way to arbitrage differences between expected and actual day-ahead congestion.

The capacity market helps ensure system reliability by paying resources to be available to meet the projected demand for electricity and operate when needed once the capacity commitment period begins.

These are services provided to the power system that are necessary for ensuring reliability in the short term.

New England’s markets have two general goals:

For these goals to be realized, the region’s markets need to be well designed so that they produce transparent, accurate prices for electric power and related products and services. Markets also need to be designed so that they attract many buyers and sellers. Markets are more competitive when they are guided by clear, understandable rules that enable low-cost participation by any potential participant.

In wholesale electricity markets, transparent and competitive prices signal when power is available in ample supply — and when and where it is expensive — to meet New England’s power demand. This provides the economic incentive for buyers and sellers to develop more cost-effective ways of producing and delivering electricity, to invest in new resources and technologies, and to manage electricity use. All these factors contribute to the grid’s overall reliability and help control power costs.

Since their inception in 1999, New England’s suite of competitive markets has facilitated the development of a power grid that is reliable, efficient, and environmentally sound. The marketplace has also grown steadily. Before markets, about 40 private and municipal utilities generated and delivered electricity in the region. Today, about 550 buyers and sellers participate in the wholesale electricity markets. Overall, the markets are working as designed, producing competitive prices that accurately reflect suppliers’ costs of delivering power to meet consumers’ real-time demand.

Today, the power grid and the industry face challenges that are dynamic and complex. Accordingly, the markets must evolve to stay in step with technological and resource advancements and government policies that affect the power system. In addition, the ISO continuously assesses the markets and market rules, procedures, and software to enhance transparency and efficiency. These enhancements expand the options and incentives for market participation.

The ISO works with market participants, state regulators, and other government officials and groups to construct a comprehensive market design that yields transparent, competitive price signals and ensures a level playing field for a large and diverse mix of participants. We also engage regional stakeholders in formal processes that strive to achieve consensus before initiating changes.

Revising market rules is an intensive process of collaboration and revision that can take many months.

A lengthy implementation phase may follow.

In addition to the formal process for revising market rules, the ISO participates in stakeholder working groups, hosts numerous meetings, and offers many lines of communication to build a common understanding of the key issues facing the region’s energy future. Obtaining stakeholder input early in the market-design process results in the timely delivery of market initiatives and facilitates approval by FERC.

In addition to designing and administering New England’s wholesale electricity markets, the ISO has other related responsibilities:

We process and produce vast amounts of data (most notably, day-ahead and real-time energy prices) for hundreds of locations across the grid, every five minutes and hourly. We clear the markets and provide twice-weekly billing services to the buyers and sellers of wholesale electricity. In addition, we ensure that proper measures are in place to mitigate participants’ exposure to credit risk should a participant default in the markets.

We issue weekly, monthly, quarterly, and annual reports that describe the performance of the markets. This information helps participants make decisions about their participation in the markets and also points to the potential need to improve the market design. The ISO also monitors market behavior and performance to ensure participants are complying with the market rules and that the markets are being operated fairly and competitively.

Our Participant Support department helps companies do business in a highly sophisticated and complex marketplace. Each year, we issue hundreds of announcements and web-based notices and respond to thousands of inquiries. We also offer extensive training.

Learn about the ISO’s other two key roles in New England’s electricity industry: